Table of Contents

Hedge Fund Manager Average Salary – Hedge Fund Supervisor Pay Increases To $2.4 Million

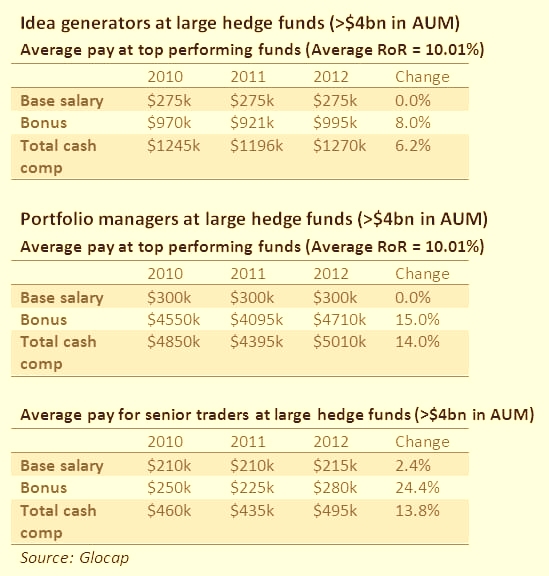

A year’s settlement for a hedge fund supervisor is more than most will make throughout their lifetime. Significant hedge funds were categorized as those that handle more than $4 billion. Experts experienced an over 5 percent boost in settlement to $372,000, with a base pay boost of 6 percent and a reward boost of around 5 percent. Info Storage and Access: These Cookies enable our partners and us to shop and access details on the gadget. Material Selection and Delivery Cookies: Data gathered under this classification can likewise be utilized to choose and provide tailored material. (Check-out the asymmetrical asset concepts that cause generational power by purchasing hedge fund manager average salary or other possessions).

Fund supervisors take advantage of market changes while regularly stabilizing high-risk financial investments with the rate of return. The high tension and the requiring hours of the task are shown in a hedge fund supervisor’s wage, in which leading earners generate billions.

The very best method to get a task as a hedge fund supervisor is by showing monetary acumen in previous functions and networking your way to the top. A hedge fund supervisor needs to discover financiers and handle the fund, consisting of connecting with business, regularly studying the monetary markets, and finding unique chances to drive returns. You will be accountable for direct financial investments in a high-risk portfolio, so establish a strong stomach early. (Get weekly expert financial investment concepts associated with hedge fund manager average salary and other chances).

A profession in hedge funds needs a strong background in the monetary market. You require a minimum of a bachelor’s degree and, ideally, a master’s degree for lots of investment-related professions. Think about finance, accounting, economics, or service administration majors and pursue a double-major, whenever possible, to set yourself apart from the competitors. Take as numerous courses as possible focused on monetary analysis if your degree course permits some versatility in course offerings. (Get weekly expert financial investment concepts associated with hedge fund manager average salary and other chances).

General financial development and the requirement for employees in specialized locations are mentioned as factors for the forecasted boost in work levels. Despite the possible increase in work numbers, robust competitors for leading tasks will still exist. Her work has appeared online with USA Today, The Nest, The Motley Fool, and Yahoo!

Shared Funds

Financiers rely on shared funds in hopes of increasing their possessions. Ending up being a fund supervisor needs education and years of experience. A fund supervisor profession supplies excellent earnings, together with the pleasure of assisting customers in accomplishing their monetary objectives. (Discover your present financial investment method, and discover how you accept danger when handling financial investment chances such as hedge fund manager average salary).

Shared funds make it possible for financiers to pool their cash in hopes of earning revenue. Since people make all the management choices, financiers like shared funds. A lot of transferred funds have a varied structure that includes possessions from many markets.

Many funds need little preliminary financial investments, which allows a broader sector of society to invest.

Mutual fund supervisors bring a great deal of duty, which includes the day-to-day management of the fund. Supervisors need to make choices about which securities to purchase and offer bonds and other properties. Financial investment supervisors select securities based upon a multipart information set, originated from examining dividends, price-to-earnings ratios, revenues, sales, and cost momentum. (Look-out for the asymmetric investment ideas that lead to generational wealth by investing in hedge fund manager average salary or other assets).

Supervisors of significant funds need to work carefully with personnel of experts to remain on top of market patterns.

In such cases, a lead supervisor takes duty for producing concepts for the group to think about before settling choices by vote.

As properties in the portfolio boost, the supervisor should set objectives for worth, development, and earnings. The portfolio supervisor should reassess and redefine the fund’s objectives if possessions reduce. (Obtain weekly professional investment ideas related to hedge fund manager average salary and other opportunities).

Marketing is an essential duty of fund supervisors. They should guarantee that customers remain abreast of monetary items and look for chances to include brand-new customers.

Fund supervisors require a minimum of a bachelor’s degree in company administration, financing, economics, or accounting. Lots of fund supervisors make the Chartered Financial Analyst * credential to advance their professions and define a hedge fund manager average salary.

The CFA procedure needs prospects to pass three levels of tests. Candidates need to have at least a bachelor’s degree and four years of work experience in any market before they can take the very first test. Each level needs 285 or more hours of the research study.

(Observe what real hedge fund managers are discussing day to day, including investment recommendations such as hedge fund manager average salary and other ideas).

Portfolio Supervisors

Portfolio supervisors require more than an excellent education, and they likewise need to have a set of necessary qualities that become part of any financial investment supervisor task description. A supervisor should have an eager eye for information to evaluate significant volumes of financial information. Fund supervisors should have remarkable analytical abilities and the capability to interact their findings with customers and executives. They should have advanced mathematics abilities and a firm grasp of worldwide financing.

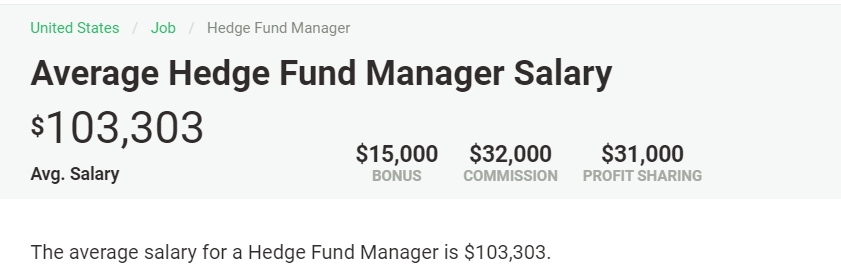

A sense of issue inspires portfolio supervisors to take on the everyday difficulties of discovering brand-new financial investments, handling the fund, and handling intricate legal matters. Low earners took house around $66,000, while supervisors at the top of the pay scale made more than $200,000.

According to BLS quotes, all monetary supervisors’ tasks should increase by around 19 percent through 2026.

As the economy has grown, businesses have collected significant money quantities, stimulated more monetary supervisors’ requirements. Regulative reform has likewise contributed to task development, as banks look for economic crisis ability. Due to the appeal of electronic banking, many financial supervisors. Michael Evans’ profession course has taken lots of prepared and unforeseen weaves, from TELEVISION sports manufacturer to web job supervisor to freight ship deckhand. (Discover your present investment technique, and learn how you accept risk when dealing with investment opportunities such as hedge fund manager average salary).

He has operated in many markets, consisting of college, the federal government, transport, financing, travel, production, and journalism. Along with the method, he has established task descriptions, spoke with task candidates, and got an insight into the kinds of education, work experience, and individual qualities companies look for in task prospects. His works have appeared in print and online publications, consisting of Fox Business, Yahoo!

Hedge Fund Manager Average Salary Sources:

https://www.cnbc.com/2014/11/06/hedge-fund-manager-pay-rises-to-24-million.html

https://work.chron.com/much-hedge-fund-managers-make-23556.html