Table of Contents

Hedge Fund Explained – A Basic Hedge Fund Meaning for Everyday Investors

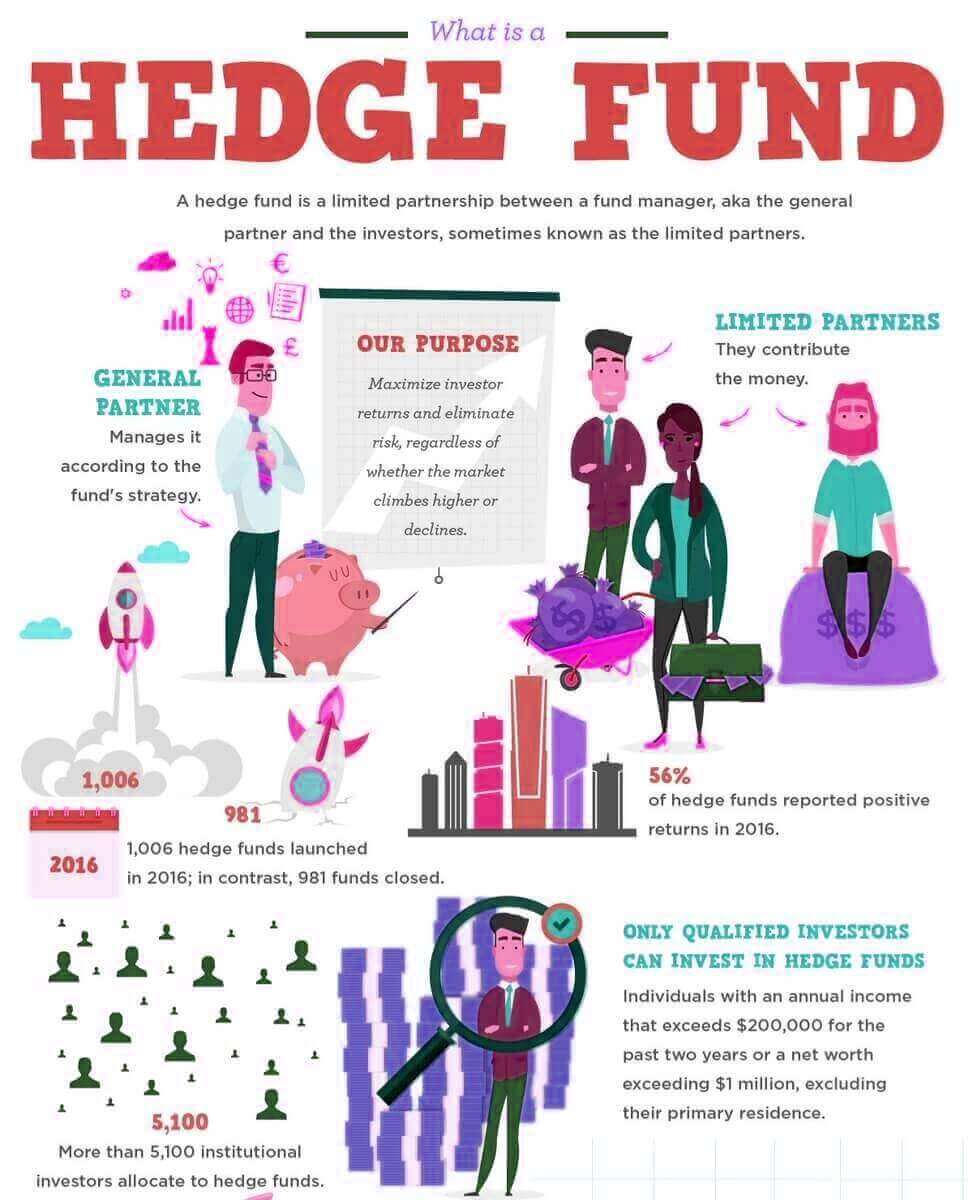

Well, put, a hedge fund is nothing more than an investment firm that invests its customers’ cash in alternative financial investments to either beat the marketplace or supplies a hedge versus unanticipated market modifications.

To comprehend the meaning of a hedge fund, we require to dig a little much more in-depth. (Check-out the asymmetric investment ideas that lead to generational wealth by investing in hedge fund explained or other assets).

Third-party financiers like pension funds, banks, and rich people buy the collaboration as minimal partners while the hedge fund management group functions as the primary partner. To do that, hedge funds utilize a wide range of techniques and methods. They invest with financial obligations, complex derivatives, stocks, bonds, choices, products, and other mystical financial investments. Some hedge funds purchase big stakes in the business and, after that, utilize those positions to affect management to make remarkable modifications to business. A lot of times, these modifications result in significant earnings for financiers and the hedge fund itself. (Get weekly professional investment ideas related to hedge fund explained and other opportunities).

Hedge funds were initially developed to offer big investment firms a method to alleviate their market dangers through direct exposure to alternative possessions.

The monetary crisis and its after-effects brought the increased policy to the market, which required modification. That increased oversight must assist in lowering the variety of bad gamers in the hedge fund market.

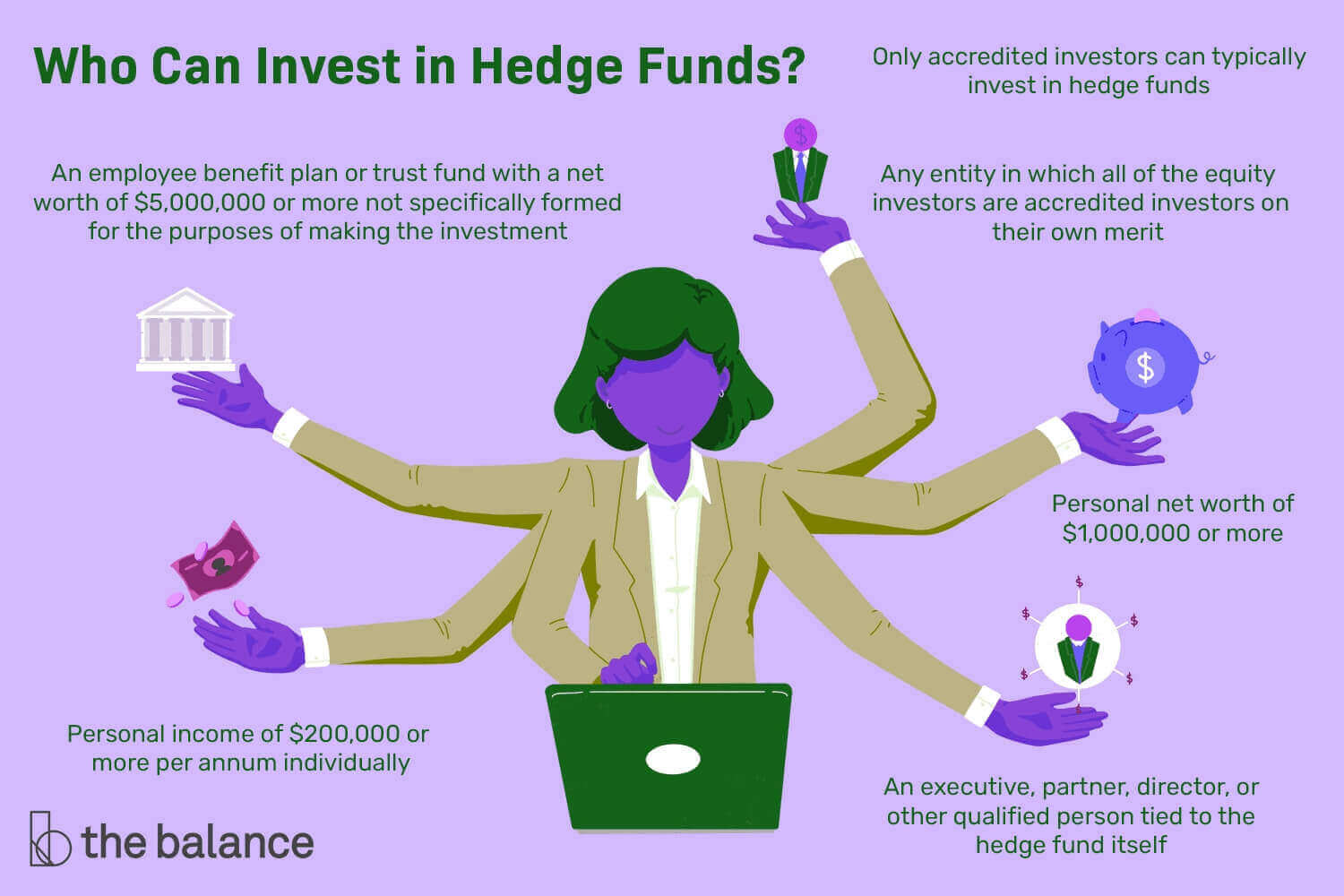

Any financier who invests with a hedge fund needs to certify a recognized financier’s sense of the policies and laws governing this market. That indicates you need to have earnings higher than $200,000 for the previous two years, or a net worth going beyond $1 million, omitting your house. Beyond merely getting your foot in the door, hedge funds likewise charge high costs and buy risky and too unpredictable securities. (See what real hedge fund managers are discussing day to day, including investment recommendations such as hedge fund explained and other ideas).

Despite the media protection and celebrity-like status of lots of leading tier hedge fund supervisors, the truth is that financial investment with a hedge fund is the finest delegated ultra-rich and institutional financiers. These companies and financiers utilize these financial investments as they were initially created– hedges versus unanticipated shocks to their core portfolios in stocks and bonds.

What Are Characteristics of Hedge Funds?

A hedge fund varies from so-called “genuine cash” since it has more liberty to pursue various financial investment techniques. One crucial quality of hedge funds is that they’re illiquid. Lots of funds sign up with these bodies anyhow, picking to provide financiers comfort and numerous securities otherwise not paid for to them. Whether signed up or not, hedge funds can’t devote scams, participate in expert trading, or otherwise break the unwritten laws. (Discover your present investment technique, and learn how you accept risk when dealing with investment opportunities such as hedge fund explained).

To publish a greater return for a provided level of threat than otherwise anticipated, a hedge fund supervisor does things in a different way than a conventional cash supervisor. This reality is where a hedge fund’s relative absence of regulative oversight ends up being essential: A hedge fund supervisor has a broad range of financial investment strategies at his disposal that isn’t possible for a securely managed financier.

Numerous hedge funds are structured under the so-called 2 and 20 plan, suggesting that the fund supervisor gets a yearly charge equivalent to 2 percent of the fund’s properties and an extra perk equal to 20 percent of the year’s earnings. (Look-out the asymmetrical asset concepts that cause generational power by purchasing hedge fund explained or other possessions).

Some hedge funds are deceptive and for a significant factor.

Hedge Fund Explained Sources:

https://www.fool.com/investing/general/2015/08/03/a-simple-hedge-fund-definition-for-everyday-invest.aspx

https://www.dummies.com/personal-finance/investing/investing-strategies/what-are-characteristics-of-hedge-funds/