Table of Contents

Spac Investment Vehicle – What Are SPACs and Should You Purchase Them?

Unique Purpose Acquisition SPACs or business is a non-operating publicly-listed business whose function is to determine and buy a personal company, permitting the acquisition target to have openly noted stock. Two hundred forty-seven recently formed SPACs raised $83 billion in capital through going public. Because it is more versatile and less complicated than going public through a preliminary public offering, personal business is ready to be gotten by SPACs. (Check-out the asymmetric investment ideas that lead to generational wealth by investing in spac investment vehicle or other assets).

The monetary markets’ receptiveness to brand-new public offerings differs depending upon financial conditions and financiers’ threat hunger. A SPAC is currently public, so a reverse merger permits a personal business to end up being public when the IPO window is closed. SPAC acquisitions are likewise appealing to personal business because their creators and other significant investors can offer a more generous portion of their ownership in a reverse merger than they would with going public. (Get weekly professional investment ideas related to spac investment vehicle and other opportunities).

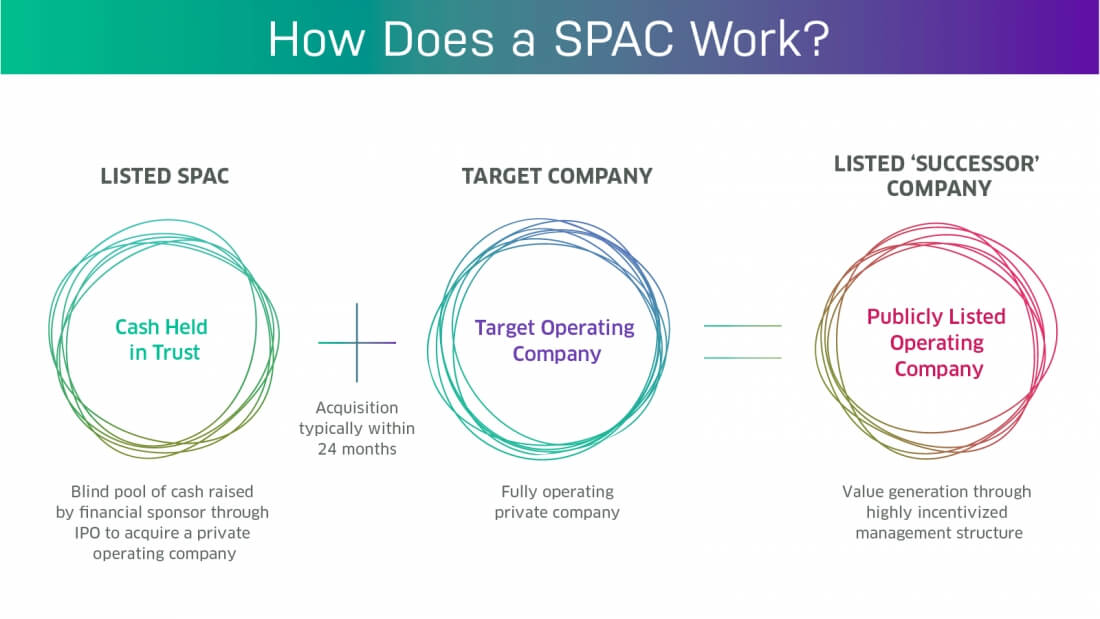

The personal business creators can likewise prevent the lock-up durations for offering recently public shares needed for going public. SPACs raise capital to get going public. A minimum of 85% of the SPAC IPO should be put in an escrow to represent a future acquisition. In practice, closer to 97% of the capital raised enters into the escrow account. In comparison, 3% is kept in reserve to cover IPO underwriting costs and SPAC business expenses, consisting of due diligence, legal, and accounting costs. (See what real hedge fund managers are discussing day to day, including investment recommendations such as spac investment vehicle and other ideas).

After the IPO, the SPAC’s management group is looking for a prospective acquisition target. Throughout this duration, the SPAC stock needs to trade near its IPO cost because the profits are kept in federal government bonds.

The day the general public is alerted about the possible acquisition is called the statement date. After the statement, the SPAC sponsors carry out extra due diligence and work out the acquisition structure.

The SPAC investors vote on whether they disapprove or authorize the acquisition. Investors likewise choose whether they wish to liquidate their shares in the SPAC. If more than 50% of investors approve the purchase and less than 20% of the investors elect liquidation, then the deal is authorized, and the gotten company is noted on the stock market. (Discover your present investment technique, and learn how you accept risk when dealing with investment opportunities such as spac investment vehicle).

If more than 50% trust the agreement, more than 20% of investors wish to liquidate their shares, then the escrow account is closed, and the profits are gone back to the investors. SPACs generally target business about 2 to 4 times the quantity that was raised in the going public. A main criticism of SPACs is the ample stock allotment the SPAC sponsors get as part of the SPAC IPO.

These Class B Founder Shares and warrants are bought for a small quantity however entitle the management to as much as 20% of the overall stock shares impressive following the IPO. Not just do these creators’ shares water down Class A typical shareholders; however, the promo can result in a dispute of interest as the sponsors have considerable upside if they close a deal even if the specific chance is not excessively engaging. (Check-out the asymmetrical asset concepts that cause generational power by purchasing spac investment vehicle or other possessions).

SEC Chairman Jay Clayton stated, “One of the locations in the SPAC area I’m primarily concentrated on and my associates are mainly concentrated on is the rewards and settlement to the SPAC sponsors.

The authors composed, “The bad financial investment record of numerous SPACs is a tip that when Wall Street presses a brand-new item, smart investors usually discover a method to move the majority of the threat onto regular financiers– even if a brand-new generation of SPAC creators thinks they will prevent the issues of the past.”

“The reality that there are many SPACs out there looking for mergers permits a running business to play them off versus each other.” I prepare to offer each SPAC holding one week after a SPAC reveals an acquisition target. A passive choice is the Defiance NextGen SPAC Derived ETF. (Get weekly expert financial investment concepts associated with spac investment vehicle and other chances).

It looks for to track the efficiency of the Indxx SPAC & NextGen IPO Index. An active ETF that looks to buy the most appealing SPACs is the SPAC and New Issue ETF. An effective SPAC acquisition can result in a windfall for the SPAC sponsors since, as part of the IPO, they get to acquire approximately 20% of the outstanding shares for a small quantity of cash.

Offered SPAC’s bad performance history, a lot of financiers need to watch out for purchasing them.

The podcast reaches 10s of countless listeners per episode and has been chosen for 6 Plutus Awards. 10 Questions to Master Successful Investing, which McGraw-Hill released. (See what real hedge fund supervisors are talking about daily, consisting of financial investment suggestions such as spac investment vehicle and other concepts).

10 Key Questions And Answers About SPACs

SPACs, or “unique function acquisition business,” are frequently in business news nowadays, with $50+ billion raised by SPACs this year alone. SPACs are approximated to end up being 50% of the IPO market this year.

1. What is a SPAC?

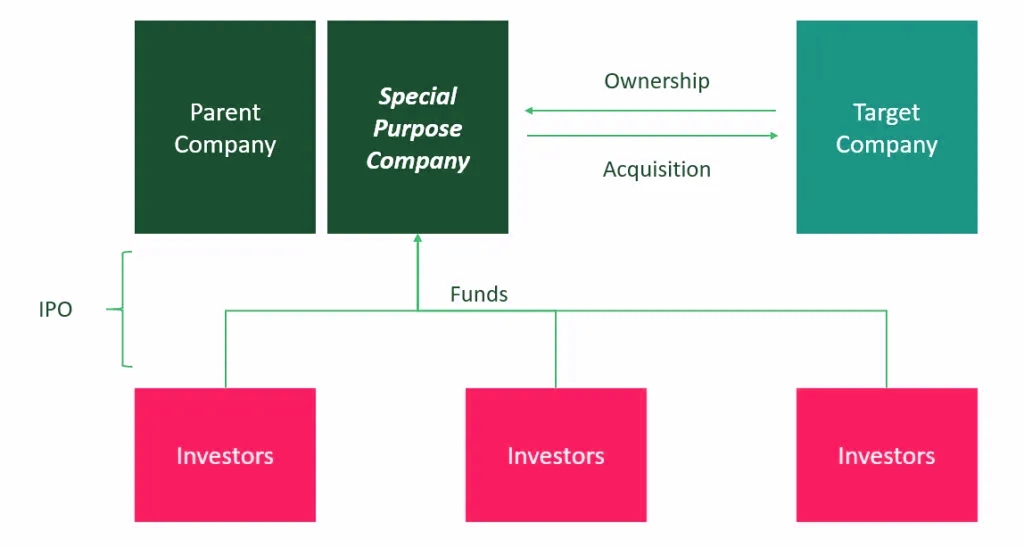

At first, a SPAC is a business with no business operations and is formed exclusively to raise capital through going public. After the money is raised and put into an interest-bearing trust account, the SPAC looks to obtain an existing independently held business through what is frequently described as a “company mix.”

If the SPAC cannot negotiate within that time, it needs to return the cash to its financiers, and the SPAC’s sponsor loses whatever preliminary financial investment it has made. SPACs provide personal business an option to the standard IPO or direct listing path. (Discover your present financial investment method, and discover how you accept danger when handling financial investment chances such as spac investment vehicle).

2. What are examples of prominent SPACs?

Billy Beane’s Red Ball Acquisition raised a $500 million SPAC concentrating on the media, information, and sports analytics sectors, with a particular target of expert sports franchises. Shaquille O’Neal, Martin Luther King III, and previous Disney executives revealed the $250 million Forest Road Acquisition Corp. SPAC for handle the tech and media area.

Chamath Palihapitiya formed a $600 million SPAC called Social Capital Hedosophia Holdings, which eventually obtained a 49% stake in the British spaceflight business Virgin Galactic. A $3.3 billion SPAC merger was revealed between Diamond Eagle Acquisition Corp. and the combined entity of DraftKings, Inc., and SBTech Limited in a synchronized three-party deal. (Review the asymmetric investment ideas that lead to generational wealth by investing in spac investment vehicle or other assets).

A $1.2 billion SPAC merger was revealed in between Momentus, Inc. and Stable Road Acquisition Corp. Palihapitiya and Ian Osborne raised $2.4 billion through 3 SPACs to effectuate company mixes in the tech sector, in offerings by Credit Suisse as sole book-runner. A $2.57 billion SPAC mix was proposed in between E2Open and CC Neuberger Principal Holdings. A $1.3 billion merger was revealed between Billtrust and South Mountain Merger.

3. Why are SPACs so popular today?

SPACs enable independently held business to go public in a quicker way than through the conventional IPO procedure. (Obtain weekly professional investment ideas related to spac investment vehicle and other opportunities).

SPAC sponsor groups tend to consist of knowledgeable and extremely accomplished experts. “With the current expansion of SPACs, our company believes that financiers will significantly concentrate on SPACs that have gifted and deeply skilled operating executives. These executives can genuinely assist business after the SPAC organization mix.” SPACs are more noticeable and recognized now, so financiers are more responsive to SPAC offerings.

“SPACs have progressed and are now thought-about a feasible option to accessing the general public markets for numerous personal business. However, they have not changed the standard IPO since they can offer more versatility, certainty, and effectiveness, they have made their location as an option.”

4. How is the preliminary SPAC IPO structured?

The registration declaration is relatively easy compared to conventional IPO registration declarations considering that the SPAC has no active service or comprehensive monetary statements. The SPAC usually provides systems consisting of one share of typical stock and a fractional warrant to get regular stock for $10 per share. Suppose the SPAC succeeds in its fundraising efforts. In that case, the capital is put into a trust until the sponsor chooses what business or business to get or utilized to redeem shares provided in the IPO.

5. How are SPAC sponsors compensated/incentivized?

When the SPAC consummates its organization mix with a target business, the creator shares usually transform into public shares, with the sponsor’s claims considerably watered down in the combined service. If an effective deal does not occur, the sponsor bears the danger of losing this financial investment. (Observe what real hedge fund managers are discussing day to day, including investment recommendations such as spac investment vehicle and other ideas).

6. How do SPACs target business to get?

Offer size. Under stock market guidelines, the business mix should be with several targets that together have an aggregate reasonable market price of a minimum of 80% of the properties kept in the SPAC’s trust account.

SPACs, like any other M&A purchaser, look to integrate with targets that the sponsors think have a significant advantage. This year, SPACs have progressively concentrated on emerging development businesses that are legally earlier than conventional IPO business.

The SEC proxy guidelines need a proxy declaration consisting of 2 or 3 years of monetary statements of the target, plus interim financial directives. The economic principles and the target’s auditor need to satisfy specific requirements. Therefore the required audit or re-audit of the target’s monetary declarations can be a gating product for the business mix. (Explore your present investment technique, and learn how you accept risk when dealing with investment opportunities such as spac investment vehicle).

The target business and its financial controls should be prepared to deal with the rigor of being a public business with regular reporting requirements. SPACs will try to find targets whose company has a significant market chance. The quality of a target’s management group will be a crucial aspect for the sponsor. The SPAC will do substantial due diligence on the target business.

7. What are the crucial working out problems in between a target and a spac business?

Normal conditions consist of investor approval, no negative product impact on the target, and any necessary regulative approvals.

8. What takes place after the SPAC concurs with a target business?

The SPAC submits a proxy statement/Form S-4 registration declaration with the SEC and waits for approval. Following SEC clearance, the celebrations obtain the vote of their investors to authorize the acquisition. If they do not like the proposed offer, SPAC investors can turn down the proposed deal, or the investors can require redemption of their stock. (Look-out for the asymmetrical asset concepts that cause generational power by purchasing spac investment vehicle or other possessions).

In some current contracts, the quantity of PIPE earnings has been considerably more prominent than the variety of funds in the SPAC’s trust account; Which leads to a lot more closing certainty for the target. As soon as authorized by the business’ particular shareholders and all other conditions of the merger arrangement are pleased, the merger is effected—the stock ticker for the SPAC modifications to show the name of the gotten business.

9. What are the crucial legal problems that emerge in SPACs?

The SPAC needs to abide by securities laws connected with its S-1 registration declaration submitted with the SEC.

On business mix with the target business, the SPAC needs to submit with the SEC a proxy declaration obtaining investor approval. Suits have been brought versus SPACs declaring shortages and misstatements in the proxy statement. The SPAC will wish to get suitable Director’s and Officer’s insurance protection, with minimal exemptions. Forecasts. The forecasts provided about the target organization require to be thoroughly prepared and caveated. (Obtain weekly expert financial investment concepts associated with spac investment vehicle and other chances).

Suitable defense for officers and directors require to be constructed into charter and indemnification arrangements.

The target business’s secret contacts must be examined to guarantee that the business mix does not activate anti-assignment arrangements. The regards to any associated PIPE offering are thoroughly recorded with the celebrations’ numerous rights and responsibilities.

Numerous laws and business governance listing requirements of the NYSE and Nasdaq will generally need those independent directors to consist of a bulk of the board. These likewise need an Audit Committee and Compensation Committee comprised of independent directors.

10. What are the dangers related to SPACs?

Typically, financiers are seen likewise to be made up for this chance expense by both the warrants and by having optionality on the De-SPAC deal if the stock cost trades upon the statement.

His focus is on Internet, digital media, and software application business, and he was the creator of several Internet businesses. His experience covers a series of M&A activity, consisting of numerous cross-border offers, de-SPAC deals, majority/minority financial investments, restructurings, and essential business matters.

He deals with personal and public business, equity capital companies, and financial investment banks concentrated on the life sciences and high-growth innovation sectors. Albert is associated with a wide variety of business legal engagements for high-growth innovation business, consisting of endeavor fundings, public offerings, public and personal business securities law compliance matters, de-SPAC deals, general business disclosure mergers, responsibilities and acquisitions, and COVID-19-related matters.

He likewise routinely encourages public and private businesses and their board of directors on business governance problems. Albert’s customers consist of public and personal firms in the life sciences, property, financing, automobile, and Internet-related markets. He likewise represents underwriters in going publics, follow-on offerings, PIPE offerings, and equity capital companies in various financial investment deals.

AllBusiness.com is among the world’s most immense online resources for small companies, offering essential tools and resources to begin, grow, and handle your organization. AllBusiness.com is among the world’s most significant online resources for small companies, offering the necessary tools and resources to begin, grow, and handle your service.

Spac Investment Vehicle Source:

https://moneyfortherestofus.com/318-what-is-a-spac

https://www.forbes.com/sites/allbusiness/2020/11/11/10-key-questions-and-answers-about-spacs